Although BTC failed to break $100,000 and is now at $96,992, institutional investors seem to believe in its potential. In particular, business intelligence firm MicroStrategy, which already owns $32 billion in BTC, announced another investment. Momentum is also evident in BTC ETFs – yesterday, net inflows reached $320.01 million.

While BTC adoption is increasing, there are few applications beyond payments. PlutoChain (PLUTO) aims to expand Bitcoin’s use cases through smart contract functionality and a cross-chain bridge.

MicroStrategy’s BTC maximalism

Michael Saylor, the head of MicroStrategy, is a well-known BTC proponent. The company’s purchase of 21,454 bitcoins in 2020, worth $250 million, was met with skepticism by some.

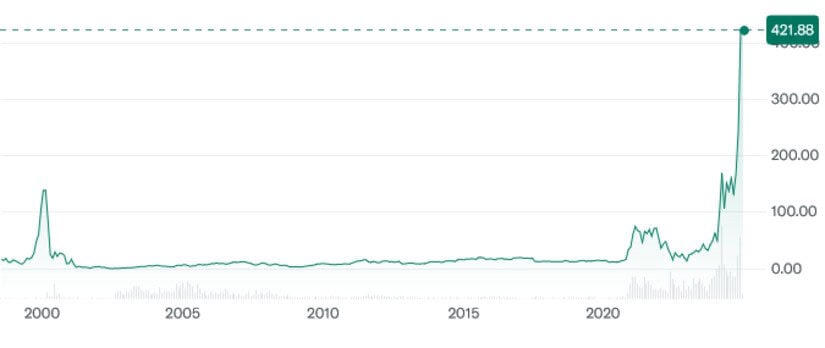

But over time, MicroStrategy’s Bitcoin-centric strategy has produced significant returns. The company’s stock price has increased 2,721% over the past five years.

MicroStrategy also strongly supports a strategic BTC reserve and predicts that the US could generate $16 trillion by investing $1 million in BTC.

Inspired by MicroStrategy’s success, Japanese investment firm Metaplanet has acquired 1,000 BTC worth around $92.3 million. The company aims to raise $42 billion for future BTC investments through stock sales by 2027.

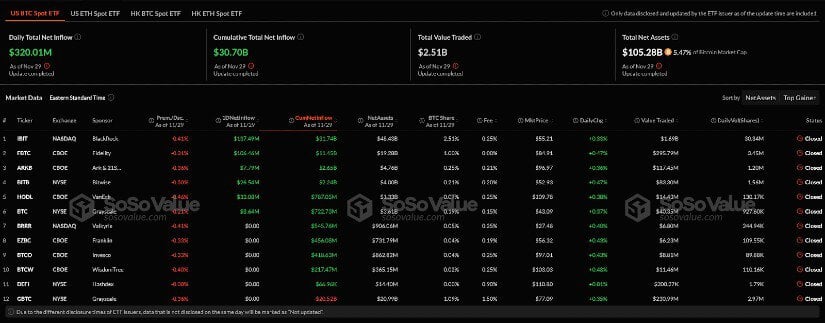

BTC ETF inflows exceed $30.70 billion

Total inflows into US Bitcoin ETFs have reached $30.70 billion. BlackRock’s IBIT ETF is the largest contributor, with inflows of $31.74 billion. Fidelity’s FBTC ETF follows close behind with $11.45 billion in inflows. However, Grayscale’s NYSE fund has seen $20.52 billion in outflows since the summer.

BlackRock’s BTC holdings exceeded $44.43 billion, which is about 2.51% of BTC’s market cap. Together, US investment firms hold over 6% of the total BTC market share.

Some people, especially those new to cryptocurrencies, see the interest of traditional financial institutions in BTC as validation. Additionally, ETFs offer a less volatile and more accessible way to invest in BTC than owning it directly.

If institutional adoption continues to grow at the same pace, BTC could reach $150,000 in 2025.

Technical indicators show that BTC could reach $130,000

Although BTC failed to break the $100,000 resistance zone, the moving averages and Average Directional Index (ADX) suggest that its bullish momentum could continue in the long term.

On the other hand, the oscillators are mixed, so BTC may undergo another correction if it encounters resistance at $98,065.

Earlier this year, analysts noticed a “cup-and-handle” formation on the BTC price chart that has historically signaled a bullish breakout. According to predictions, BTC could soon reach $130,000.

PlutoChain could expand Bitcoin’s capabilities by potentially integrating new applications

Although investment firms and banks are adopting BTC, they primarily view it as a reserve asset. Ethereum still holds the largest share of the dApp market.

With the introduction of smart contracts, the Layer 2 network PlutoChain could expand the functionality of Bitcoin. This would allow developers to build native dApps on Bitcoin or port them from Ethereum.

Solid Proof’s audit of PlutoChain’s codebase revealed no serious security vulnerabilities. This means that PlutoChain offers a reliable toolkit that could potentially expand Bitcoin’s ecosystem.

Currently, the total value of the Bitcoin Finance Industry (BTCFi) is just 0.13% of BTC’s $1.92 trillion market cap. When the price of BTC reaches $150,000, its capitalization will exceed $2.80 trillion.

Last words

The Bitcoin ecosystem has evolved significantly over the years, but its development is still at an early stage. PlutoChain could be the next step in its development. With increasing adoption by developers and institutions, BTC could soon surpass $150,000.

Visit the following links to learn more about PlutoChain and its unique features:

Official website: https://plutochain.io

X/Twitter page: https://x.com/plutochain/

Telegram channel: https://t.me/PlutoChainAnnouncements/

Please note that this article is for informational purposes only and not financial advice. All cryptocurrencies are volatile and prices fluctuate quickly. Always do your own research and consult an expert before joining a crypto company. We assume no liability for any results based on the information in this article. Forward-looking statements involve risks and may not reflect updates.

This is a sponsored article. The opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on the information presented in this article.