Legendary fund manager Li Lu (whom Charlie Munger backed) once said: “The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.” When we think about how risky a company is, we look We always recommend the use of debt, because over-indebtedness can lead to ruin. As with many other companies Cabka NV (AMS:CABKA) uses debt. But is this debt a problem for shareholders?

When is debt dangerous?

Debt and other liabilities become risky for a company when it cannot easily meet those obligations, either through free cash flow or by raising capital at an attractive price. If the company can’t meet its legal obligations to pay down debt, shareholders could end up with nothing. While this isn’t all that common, we often see indebted companies permanently diluting their shareholders because lenders force them to raise capital at a distressed price. However, the most common situation is for a company to manage its debt reasonably well – and to its own advantage. When we examine debt levels, we first consider both cash and debt levels together.

Check out our latest analysis for Cabka

How much debt does Cabka have?

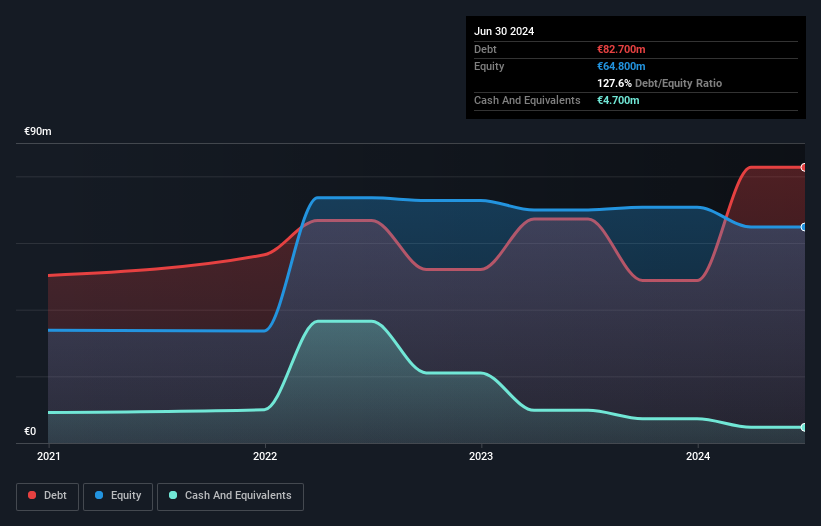

As you can see below, Cabka had debts of €82.7 million at the end of June 2024, up from €67.2 million the previous year. Click on the image for more details. However, since the company has a cash reserve of EUR 4.70 million, net debt is lower at around EUR 78.0 million.

How strong is Cabka’s balance sheet?

The latest balance sheet data shows that Cabka had liabilities of €81.7m within a year, and liabilities of €42.5m falling due after that. This compares to €4.70m in cash and €31.9m in receivables that were due within 12 months. So its liabilities total €87.6m more than the combination of its cash and short-term receivables.

Considering that this deficiency exceeds the company’s market capitalization of €59.3 million, one might well be inclined to examine the balance sheet closely. In the scenario where the company had to clean up its balance sheet quickly, it would likely be that shareholders would suffer significant dilution. There is no doubt that the balance sheet is where we learn the most about debt. Ultimately, however, the company’s future profitability will determine whether Cabka can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Last year, Cabka posted a loss before interest and taxes and even shrank its turnover by 15% to 187 million euros. That’s not what we would want.

Precautionary measure

While Cabka’s falling revenue is about as heartwarming as a wet blanket, its loss of earnings before interest and tax (EBIT) is arguably even less attractive. Specifically, the EBIT loss amounted to €1.1 million. When we consider that together with the significant liabilities, we’re not particularly confident about the company. It would have to improve its operations quickly for us to be interested. Not least because the company burned negative free cash flow of 12 million euros last year. So suffice it to say we think the stock is risky. There is no doubt that the balance sheet is where we learn the most about debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Note that Cabka can be seen 4 warning signs in our investment analysis and one of them should not be ignored…

Ultimately, sometimes it’s easier to focus on companies that don’t even need debt. Readers can access a list of growth stocks with no net debt 100% freeat the moment.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued small caps due to insider buying

• High-growth technology and AI companies

Or create your own from over 50 metrics.

Explore now for free

Do you have feedback on this article? Worried about the content? Get in touch directly with us. Alternatively, you can also send an email to editor-team (at) simplywallst.com.

This article from Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only an unbiased methodology and our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term focused analysis based on fundamental data. Note that our analysis may not reflect the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.