Legendary fund manager Li Lu (who Charlie Munger backed) once said: “The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.” So it seems that smart people know that debt – that usually accompanied by bankruptcies – a very important factor when assessing the risk of a company. We can see that Shandong Weifang Rainbow Chemical Co., Ltd (SZSE:301035) uses debt in its business. But the real question is whether this debt makes the company risky.

When is debt dangerous?

Debt is a tool that helps companies grow. However, if a company is unable to repay its lenders, it is at their mercy. A key component of capitalism is the process of “creative destruction,” in which failed companies are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario involves having to raise new equity capital at a low price, resulting in permanent shareholder dilution. However, the most common situation is for a company to manage its debt reasonably well – and to its own advantage. The first step when considering a company’s debt levels is to consider its cash and debt together.

Check out our latest analysis for Shandong Weifang Rainbow Chemical

How much debt does Shandong Weifang Rainbow Chemical have?

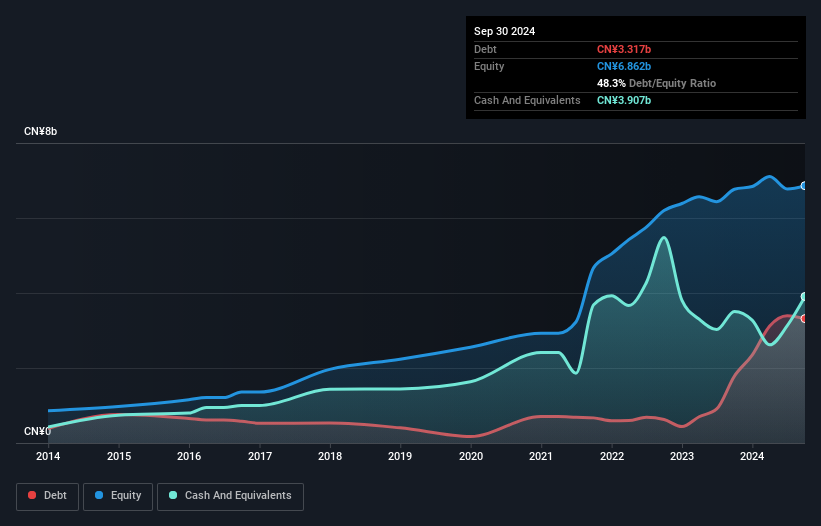

The image below, which you can click on for more details, shows that Shandong Weifang Rainbow Chemical had CN¥3.32 billion in debt as of September 2024, up from CN¥1.78 billion in one year. However, to offset this, the company also has CN¥3.91b in cash, meaning it has CN¥590.0m in net cash.

How healthy is Shandong Weifang Rainbow Chemical’s balance sheet?

The most recent balance sheet shows that Shandong Weifang Rainbow Chemical had liabilities of CN¥8.73b in a year, and liabilities of CN¥420.8m beyond that. Offsetting this, it had cash of CN¥3.91b and receivables worth CN¥4.96b due within 12 months. So its liabilities total CN¥283.4m more than the combination of its cash and short-term receivables.

This state of affairs suggests that Shandong Weifang Rainbow Chemical’s balance sheet looks quite solid, with total liabilities roughly equal to its cash and cash equivalents. So it’s very unlikely that the CN¥14.4b company is strapped for cash, but it’s still worth keeping an eye on the balance sheet. While Shandong Weifang Rainbow Chemical has significant liabilities, it also has more cash than debt, so we’re fairly confident that the company can manage its debt safely.

However, the bad news is that Shandong Weifang Rainbow Chemical’s EBIT fell 18% over the last twelve months. We believe that this performance, if repeated frequently, could well spell trouble for the stock. The balance sheet is clearly the area to focus on when analyzing debt. But it is future earnings that will determine whether Shandong Weifang Rainbow Chemical can maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay off its debts with paper profits; it takes cash. Although Shandong Weifang Rainbow Chemical has net cash on the balance sheet, it’s still worth taking a look at its ability to convert earnings before interest and taxes (EBIT) to free cash flow to help us understand how quickly the company is growing ( or decreases). this cash balance. Over the past three years, Shandong Weifang Rainbow Chemical has experienced significantly negative free cash flow overall. While that may be due to growth spending, it makes debt far riskier.

In summary

While it’s always useful to look at a company’s total liabilities, what’s very reassuring is that Shandong Weifang Rainbow Chemical has net cash of CN¥590.0m. So while we see some room for improvement, we’re not too worried about Shandong Weifang Rainbow Chemical’s balance sheet. When analyzing debt levels, the balance sheet is the obvious place to start. However, not all investment risks lie on the balance sheet – quite the opposite. For this purpose, you should inform yourself about the 3 warning signs We discovered Shandong Weifang Rainbow Chemical (including one that doesn’t go down too well with us).

Ultimately, sometimes it’s easier to focus on companies that don’t even need debt. Readers can access a list of growth stocks with no net debt 100% freeat the moment.

New: Manage all your stock portfolios in one place

We created this ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total in one currency

• Be alerted to new warning signs or risks via email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Worried about the content? Get in touch directly with us. Alternatively, you can also send an email to editor-team (at) simplywallst.com.

This article from Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only an unbiased methodology and our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term focused analysis based on fundamental data. Note that our analysis may not reflect the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.