Key insights

- Marathon Digital Holdings has increased its offering of convertible notes for Bitcoin acquisitions to $850 million.

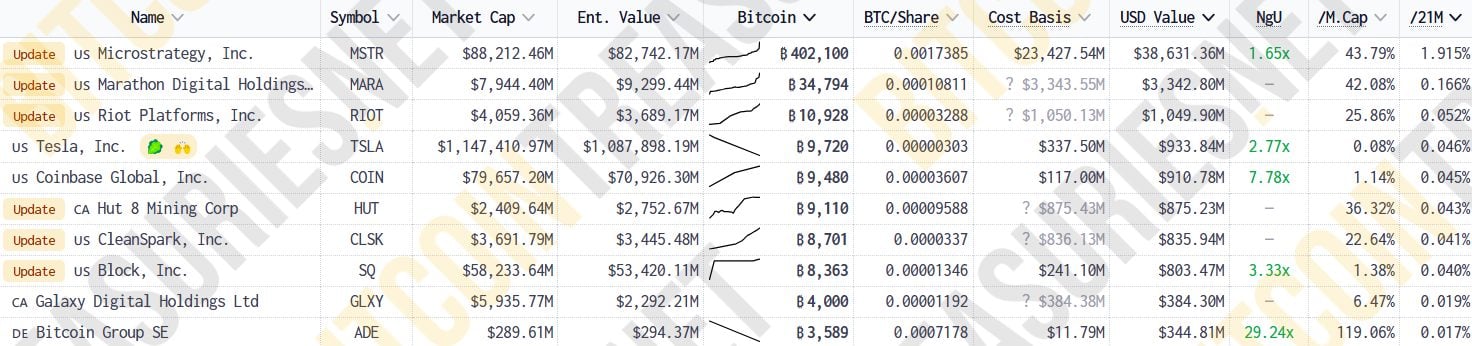

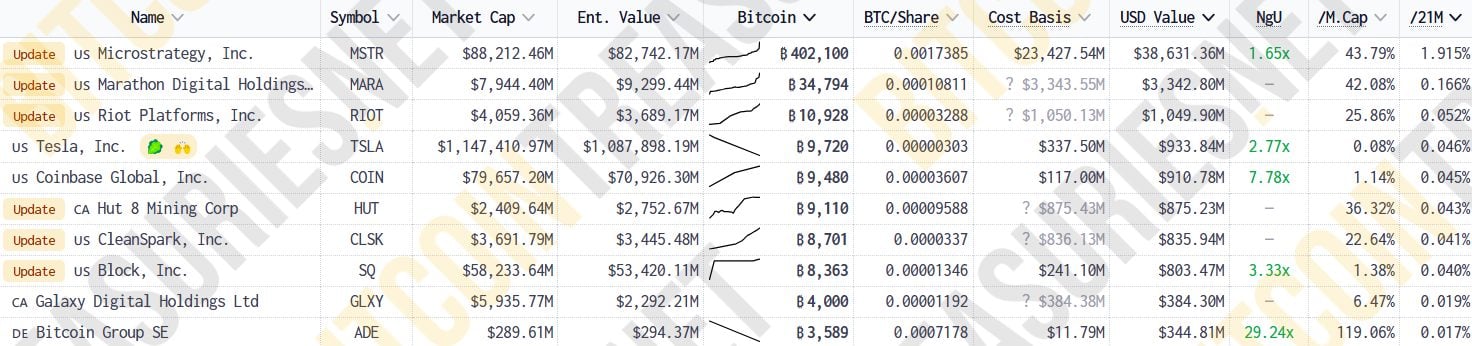

- Marathon is the second largest corporate Bitcoin holder with 34,794 BTC worth $3.3 billion.

Share this article

MARA Holdings (MARA), Wall Street’s largest publicly traded Bitcoin miner, has increased its offering of convertible notes to $850 million from $700 million and plans to use a portion of the net proceeds for future Bitcoin acquisitions, it said it in a statement on December 2nd.

MARA Holdings, Inc. Announces Pricing for Oversubscribed and Enlarged Offering of Zero-Coupon Convertible Notes Due 2031https://t.co/3PYqjzn2A7

– MARA (@MARAHoldings) December 3, 2024

The interest-free notes, due 2031, are convertible into cash, common stock or a combination of both, at the Company’s discretion.

The Bitcoin mining company expects to raise net proceeds of approximately $835 million from the offering, with a potential of $982 million if additional notes are purchased in full.

MARA plans to allocate $48 million of the proceeds to repurchase approximately $51 million of existing convertible notes due 2026.

The majority of the remaining net proceeds from the sale of the Notes will be used to purchase additional Bitcoin. These funds are also used to support various corporate initiatives, such as strategic acquisitions.

The company recently acquired 703 Bitcoin in November, bringing its total monthly purchases to 6,474 BTC, after previously raising $1 billion through the sale of a zero-interest convertible note. Marathon also committed $160 million to buy the dip.

MARA now holds 34,794 Bitcoin worth $3.3 billion, solidifying its position as the second-largest corporate Bitcoin holder behind MicroStrategy, which recently purchased $1.5 billion worth of Bitcoin.

Share this article