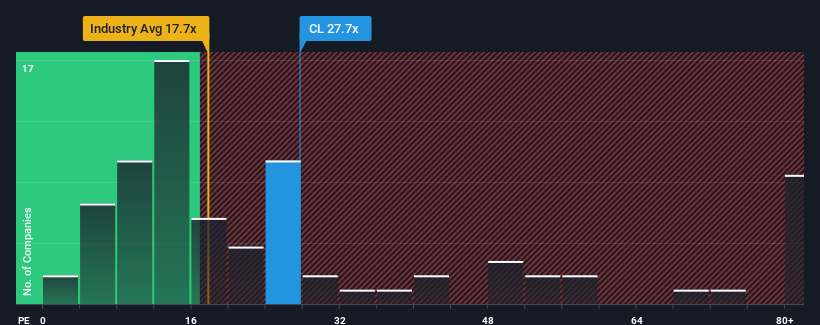

With a price-to-earnings ratio (or “P/E”) of 27.7x Colgate-Palmolive Company (NYSE:CL) may be sending bearish signals right now, as nearly half of all companies in the United States have P/E ratios below 19x, and even P/E ratios below 11x are not uncommon. However, the P/E ratio may be high for a reason and further research is needed to determine whether it is justified.

Colgate-Palmolive has certainly done a good job of late, as the company has grown its profits more than most other companies. The P/E ratio is likely high as investors expect this strong earnings trend to continue. If not, existing shareholders may be a little nervous about the sustainability of the share price.

Check out our latest analysis for Colgate-Palmolive

Want a complete overview of analyst estimates for the company? Then ours free The Colgate-Palmolive report will help you figure out what’s on the horizon.

What do growth metrics tell us about the high P/E ratio?

To justify its P/E ratio, Colgate-Palmolive would need to deliver impressive above-market growth.

Looking back, last year resulted in an extraordinary 83% increase in company profits. The last three-year period also saw an overall increase in earnings per share of 12%, largely due to short-term performance. Accordingly, shareholders are likely to have been satisfied with the medium-term profit growth rates.

Looking ahead, estimates from the company’s analysts suggest that earnings are expected to grow 8.1% per year over the next three years. Since the market is forecast to grow at an annual rate of 11%, the company expects a weaker profit result.

Based on this information, we find it concerning that Colgate-Palmolive is trading at a P/E ratio that is above the market. Apparently, many of the company’s investors are much more optimistic than analysts suggest and are unwilling to offload their shares at any price. Only the bravest assume these prices are sustainable, as this level of earnings growth is likely to ultimately weigh heavily on the share price.

What can we learn from Colgate-Palmolive’s P/E ratio?

We typically caution against reading too much into the price-to-earnings ratio when making investment decisions, even though it can reveal a lot about what other market participants think about the company.

Our review of Colgate-Palmolive’s analyst forecasts found that the weakening earnings outlook isn’t impacting the company’s high P/E ratio nearly as much as we would have expected. If we see a weak earnings outlook with slower growth than the market, we suspect the share price is at risk of falling, which would result in a decline in the high P/E ratio. Unless these conditions improve significantly, it will be very difficult to accept these prices as reasonable.

You should always think about risks. Case in point: We discovered it 2 warning signs for Colgate-Palmolive You should be aware of that.

If you are interested in P/E ratiosmaybe you would like to see this free Collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued small caps due to insider purchases

• High-growth technology and AI companies

Or create your own from over 50 metrics.

Explore now for free

Do you have feedback on this article? Worried about the content? Get in touch directly with us. Alternatively, you can also send an email to editor-team (at) simplywallst.com.

This article from Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only an unbiased methodology and our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term focused analysis based on fundamental data. Note that our analysis may not reflect the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.